Restricted use of Control Accounts in MYOB Advanced

MYOB Advanced Tips and Tricks #7Having reconciled and balanced accounts is vital to accurate financial reporting. Posting directly to the General Ledger Control Accounts can cause imbalances between sub-ledgers and their respective balance sheet accounts. Introduced in Release 2020.3, MYOB Advanced (powered by Acumatica) now provides the ability to restrict direct postings of transactions, such as journal entries, to control accounts.

Impacts of restricting control accounts

You can set restricted control accounts against the following sub-ledgers: Accounts Payable, Accounts Receivable, Fixed Assets, Inventory, Taxes (GST), Purchase Orders (Receipts), and Sales Orders (Shipments).

Establishing a control account has two impacts:

- Removes the opportunity for manual data entry directly into the account and reduces error rates.

- Prevents using the account as a default for fields related to sub-ledgers. For example, the Sales or Expense accounts are set in the Accounts Receivable or Accounts Payable master record.

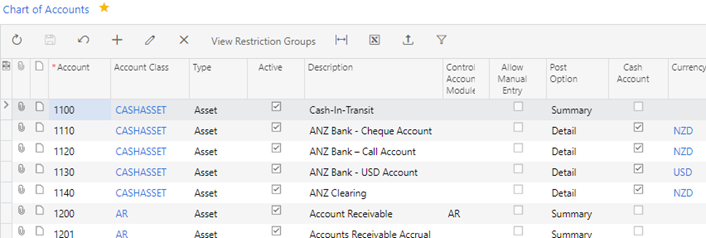

Two new columns are added to the Chart of accounts Screen to display further and customise the account restrictions.

You can select the related sub-ledger Module alongside each General Ledger account, marking it as a control account. As per the example below, we have chosen the “AR” control to align with the Accounts Receivable General Ledger Account.

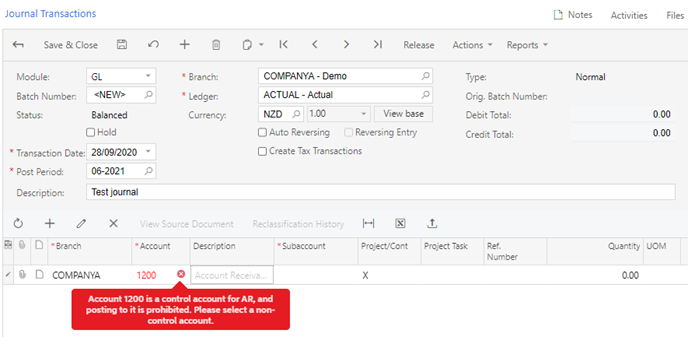

The “Allow Manual Entry” check box determines if users can post entries directly to this account. Clearing the box will prevent users from creating entries to this account.

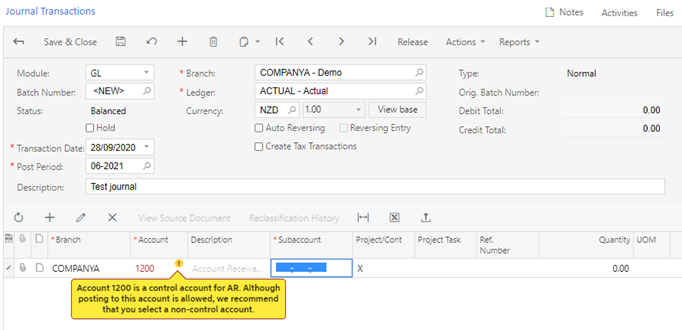

Checking this box will allow users to post transactions, although they will still receive a warning. We recommend that you uncheck this box after having made the necessary adjustments.

We recommended enabling the use of ledger control accounts to help prevent sub-ledger imbalances.

Are you interested in other ways to optimise MYOB Advanced?

Check out our handy MYOB Advanced Tips and Tricks blogs here:

- Generating On-Demand Statements in MYOB Advanced

- The New User Interface – MYOB Advanced

- Row-Level Security in MYOB Advanced

- Generic Inquiries in MYOB Advanced

- Fixed Assets in MYOB Advanced

- Business Events in MYOB Advanced

- Restricted use of Control Accounts in MYOB Advanced

- Corporate Cards in MYOB Advanced

- Matrix Items in MYOB Advanced

- Restricted Visibility of Customer and Supplier Records

- Important features of reporting dashboards

- The Global Search Function in MYOB Advanced

- Learn to Streamline your Intercompany Sales

- Simplify Your Cross-Company Sales

- Adding one-off public holidays to MYOB Advanced Payroll

- Deferral Schedules in MYOB Advanced

- Keyboard shortcuts to improve efficiency in MYOB Advanced

We hope these tips and tricks were helpful to you! If you have any questions about Control Accounts in MYOB Advanced, our friendly team is here to help. Call us on 1300 857 464 (AU) or 0800 436 774 (NZ), or send us an email.

Alternatively, for a comprehensive overview of all of our best MYOB Advanced ‘hacks’ in one place, you can download our PDF from the panel on the right – The Ultimate Compilations of Tips and Tricks!